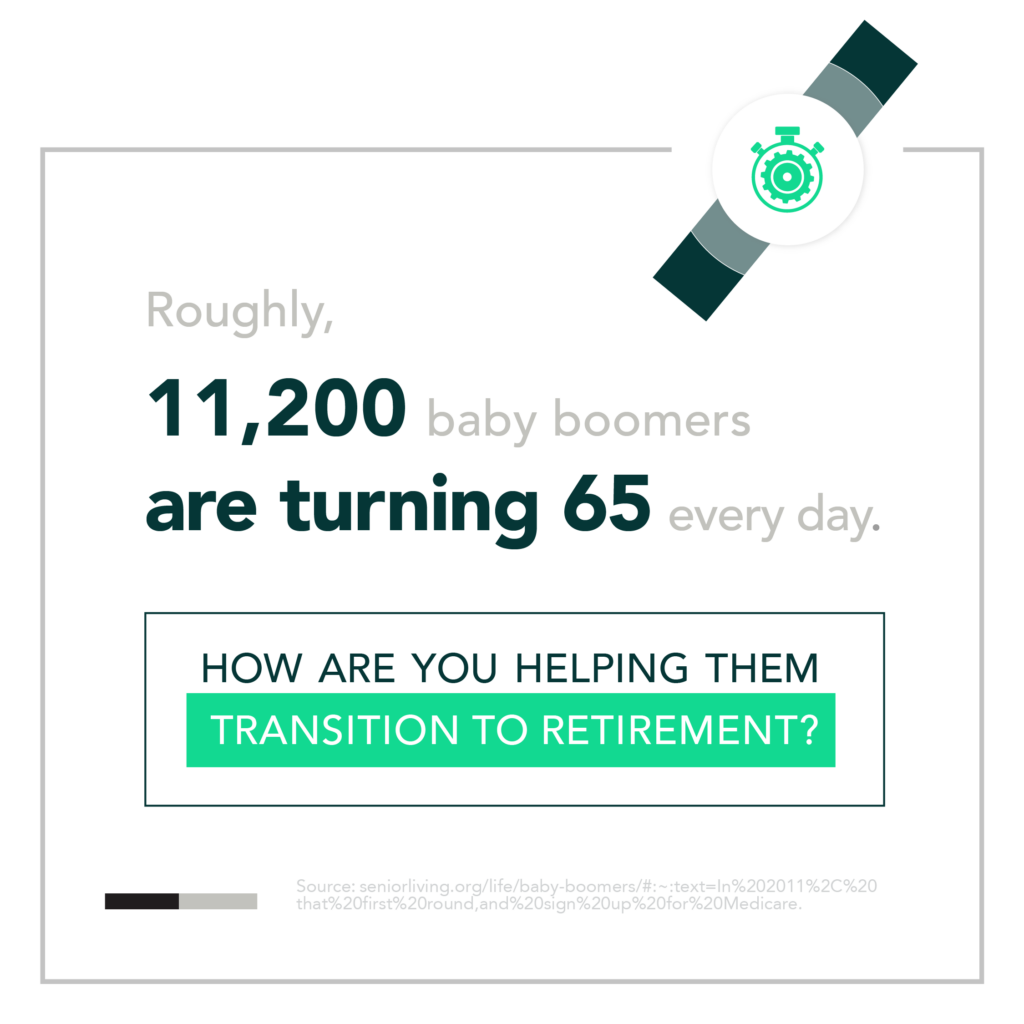

Help Clients Through Retirement Transitions

The transition from work to retirement can be an exciting and scary time for clients.

It’s important to remember that your clients have been working toward this moment throughout their entire careers.

With nearly 11,200 baby boomers turning 65 every day1 and more than half of Americans feeling behind on their retirement savings,2 proper planning is more important than ever.

Guide the conversation

It’s never too early to start helping your clients prepare for retirement.

When a person retires, no one hands them a guide on how to be a retiree. They may need advice from friends, family — and from you.

Since there is no one-size-fits-all strategy to prepare for retirement, talking to your clients about how they want to spend their retirement is a great place to start.

Retirement Transition Topics to Help Your Clients

By touching on these topics, you may elevate the client experience and build a better client/financial professional relationship.

Retirement Planning

Social Security Strategies

High-level planning conversations may enhance the client experience and set you apart from the competition.

Nurture Relationships

Estate Planning & Legacy

Client Satisfaction

Purpose In Retirement

Insights for Financial professionals

Looking to grow your client base?

See how legacy planning can help financial professionals tap into new lead sources.

Choose the right annuity for your clients’ financial goals

Explore annuity options that can help your clients grow and protect their savings — and step into retirement with greater confidence.

Product availability may vary by organization. For more information, contact your IMO or the Guaranty Income Life Sales Desk at 800-535-8110.

Explore more strategies to maximize impact and improve client engagement